Searching for Yield: At Any Cost?

Kieran Osborne, CFA, Co-Portfolio Manager, Merk Mutual Funds September 08, 2010 In an environment with historically low interest rates, fixed income investors have been pouring money into longer-duration securities, substituting 3 and 6 month T-Bills with 10-year Treasures or bond funds. To an extent, this should not be so surprising: the Federal Reserve’s (the Fed) extraordinary monetary policies have resulted in extremely low yields at the short end of the yield curve. Investors seeking yield have been forced out the yield curve or into increasingly risky investments in an attempt to gain higher investment returns. However, this is not a strategy without risks, both at the individual investor level and for the economy as a whole. Are the Fed’s monetary policies, combined with the government’s decision to issue increasing levels of longer duration debt, having the unintended consequence of stoking the fire for further financial stress?

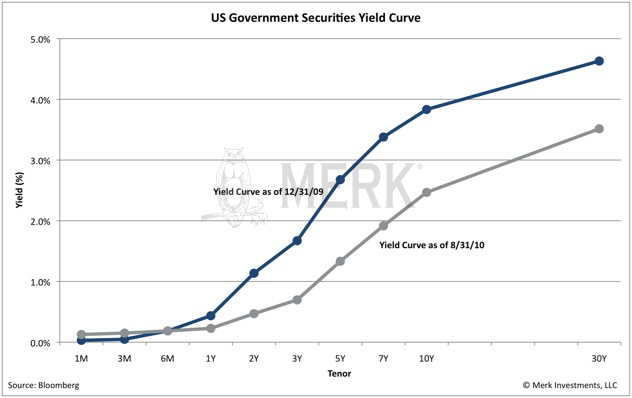

While many observers focus on the increased risks associated with moving into lower quality, higher yielding instruments, and away from the likes of government securities, often overlooked is the increased risk associated with simply moving out along the yield curve. Fixed income investments become evermore risky the further out the yield curve investors move. Moving from the short end of the curve into similar quality fixed income securities at the longer end of the curve may have a marked impact on the overall risk profile of a portfolio, as we will explain in more detail below. Of course, increasing the exposure to lower quality fixed income securities also implicitly raises an investment portfolio’s risk profile, and should be a key consideration before any such decision is made. Longer duration fixed income securities may have a greater propensity to cause “black swan” type events, given that they historically display fat tail return distributions and much higher levels of price volatility relative to shorter-duration securities. We are most concerned that the aggregate risk profile of many fixed income investments, and especially those underlying future obligations, may have now increased. The implications could be potentially disastrous: the likelihood of another financial catastrophe may have risen; many investments that everyday Americans are relying upon provide future financial security may have been put in jeopardy. Now may be the time for investors to consider fixed income investments at the short-end of the yield curve to take advantage of the diversification benefits fixed income investing may offer, while seeking to mitigate interest risk. Investing outside of the U.S. dollar may also prove beneficial, should present dynamics negatively affect U.S. economic stability. Recent Treasury data tells an interesting story. Over the 12 months through March 31, 2010, the level of T-Bills held by the public has fallen by 9.4%, whereas Treasury notes and Treasury bonds held by the public have increased by 48.0% and 22.9%, respectively. In just one year, the average length of marketable public debt held by private investors has increased by 7 months: from 3 years, 11 months to 4 years, 6 months1. There has been a dramatic shift in the term structure of interest rates, as evidenced by changes to the yield curve:

To a large extent, the changes in public Treasury holdings has been driven by the Federal government’s choice to issue greater levels of longer duration securities. However, the story that these statistics, in concert with the yield curve, paint is very important: for there to be a decrease in the yield of longer duration securities (as depicted above), which infers an increase in price, there would require greater investor demand, all else equal. But all things have not been equal: the government has issued vast amounts of longer duration notes and bonds, increasing the supply of these same longer duration instruments. When the supply of any security increases, with no increase in demand, the net effect should be an increase in the yield (decrease in price), but the opposite has happened. By implication, these dynamics infer that the level of demand for longer duration fixed income securities has outstripped the increase in supply; investor preference has shifted to longer-dated securities. Another important observation is that the opposite has happened at the short end of the curve: the government has reduced the level of T-bills outstanding (reduced supply), yet yields have increased (prices have fallen), implying that the demand for T-bills has fallen more sharply than the decrease in supply. The market has actively shifted out of the short end of the yield curve and into the long end. Axel Merk's book, Sustainable Wealth: Achieve Financial Security in a Volatile World of Debt and Consumption is available now.

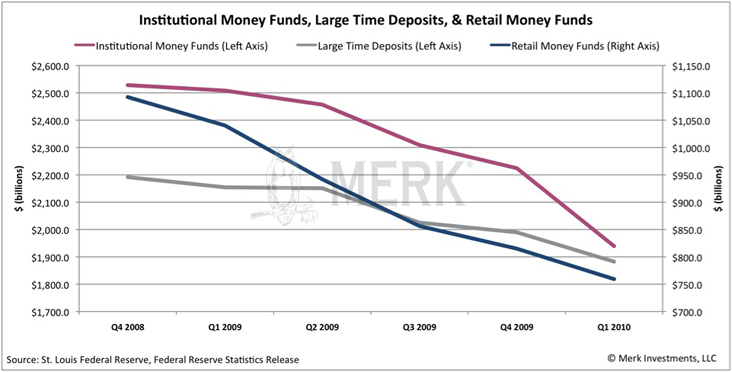

These trends are also evident in traditional measures of short-duration investments. We have witnessed a reduction in both retail and institutional money fund assets, along with a reduction in large time deposits held at financial institutions:

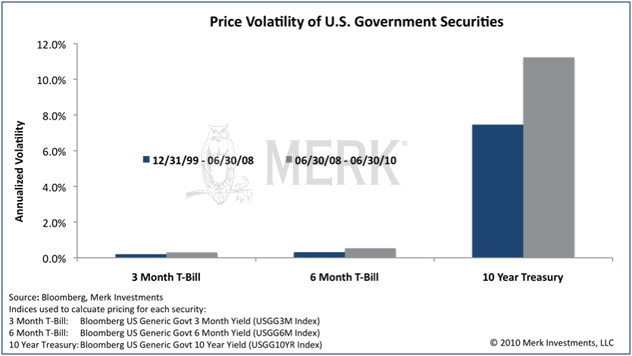

Of course, increased perceived risks associated with money market funds, brought about by the Reserve Primary Fund “breaking the buck” in 2008, reducing its net asset value to below $1 due to Lehman Brothers’ bankruptcy filing, may have acted as a catalyst for some investors to redeploy funds further out the curve or into other asset classes. In our opinion, investors may be jumping from the frying pan into the fire. Investors may be jumping from the frying pan into the fire. It is widely acknowledged that longer duration fixed income securities are more susceptible to interest rate risk than shorter duration securities. What is less well known is that longer duration securities exhibit much larger, more frequent movements in price than a normal “bell-shaped” curve would suggest, and may therefore be more prone to causing black swan type events. Investors don’t even need to consider an extreme (albeit possible) future scenario, such as the Chinese or Japanese authorities dumping their U.S. debt holdings, for this to occur. Just consider the historic underlying attributes of the 10-year Treasury: The annualized price volatility of 10-year Treasuries has historically been much higher than short-term T-Bills. The following chart depicts price volatility over two separate timeframes: leading up to the recent financial crisis (12/31/1999 – 06/30/08) and since its onset (06/30/08 – 06/30/10):

Research conducted by the Federal Reserve Bank of St. Louis found that 10-year Treasury prices exhibited much wider tails than would be expected by a normal distribution, commonly referred to as “fat tails”2. The research analyzed the volatility of movements in price of the 10-year Treasury bond over a period of more than 25 years. The results indicate that investors may be subject to significant interest rate and price risk when investing in longer duration securities. It found that there are 16 times more price changes in excess of 3.5 standard deviations than expected with a normal distribution. Furthermore, whereas changes in price greater than 4.5 standard deviations would occur only 7 times in a million under the normal distribution, the findings showed 11 changes in 6,573 observations. One only needs to look to the recent financial crisis as an example of how fat tail events can wreak financial havoc if not properly addressed as part of a comprehensive approach to risk management, and that is where the problem may lie. We remain skeptical that many of those who have moved out along the yield curve have the sophistication needed to properly manage the increase in risk profile of their underlying investments. More concerning is that many may be the institutions in charge of managing assets anticipated to provide future income streams and financial security for many working class Americans: during the 12 months to March 31, 2010, life insurance companies increased holdings of Treasury issues by 27.1%, private pension funds increased their holdings by 59.4%, state and local government retirement funds increased holdings by 20.9%3. Should these institutions fail to meet their objectives, it could potentially precipitate a massive hit to the U.S. economy and financial system, and a collapse in the U.S. dollar. Over this same timeframe the household sector increased its holdings of Treasury issues (outside of non-marketable savings bonds) by a whopping 72.8%, while commercial banks increased their holdings even more, by 115.4%4. Not only may have the Fed’s policies contributed to an increase in the risk profile of investments throughout the economy, but it may also have driven the prices of long-term bonds towards bubble territory. Moving further and further out the yield curve appears to have become an evermore-crowded trade. Should we witness a substantial reversal in sentiment, the risk of large movements in price may be compounded, as many investors scramble to exit their positions. A significant inflationary shock to the system may prompt such a reaction; a very real threat in our opinion, given the vast amounts of money the Fed has been printing. At some point, the deteriorating public finances of the U.S. government may eventually force investors to reevaluate the rate at which they are compensated for holding U.S. debt obligations. The U.S. fiscal situation has deteriorated significantly, yet the rate the government pays to issue debt has fallen. While the rest of the world is tightening the hatches, imposing fiscal austerity measures, there is little evidence of a concerted effort to rein in government spending on either side of the aisle in the U.S. If the U.S. fiscal situation continues to worsen, debt of foreign governments with similar maturities may become comparatively more attractive. If and when the dam breaks, many investors could be in for a rude awakening: this is likely to put upward pressure on rates in the U.S., causing bond prices to fall and may put renewed pressure on the U.S. dollar should investors move money offshore. There is a high likelihood that the risk profile of commonly considered “safe” investments – high quality fixed income – has actually deteriorated on aggregate, throughout the economy, by virtue of extremely low rates brought about by the Fed’s monetary policies. In our opinion, investors should be mindful of the potential risks associated with investing in longer-duration fixed income securities, especially if they harbor concerns over inflation or rising interest rates globally. As interest rates rise, fixed income securities typically fall in value: the longer the duration of the security, the greater the fall in price. Investors may want to consider diversifying internationally to protect against the risk of these scenarios playing out. Many short-maturity international government debt instruments already pay much higher rates than the very low rates available at the short end of the curve in the U.S. Indeed, we have witnessed many international central banks raising interest rates recently. As such, investors may want to consider investing in international fixed income at the short end of the yield curve. Ensure you sign up for our newsletter to stay informed as these dynamics unfold. We manage the Merk Absolute Return Currency Fund, the Merk Asian Currency Fund, and the Merk Hard Currency Fund; transparent no-load currency mutual funds that do not typically employ leverage. The Merk Hard Currency Fund can be considered an international fixed income fund with a firm commitment to the short end of the yield curve. To learn more about the Funds, please visit www.merkfunds.com. The Merk Hard Currency Fund (MERKX) normally invests in a basket of hard currency denominated investments composed of high quality, short-term debt instruments of countries pursuing “sound” monetary policy. The average maturity of these debt instruments has historically been less than 180 days. Both the Merk Asian Currency Fund (MEAFX) and Merk Absolute Return Currency Fund (MABFX) have historically utilized forward currency contracts to gain currency exposure. The notional value of these contracts is typically fully collateralized with U.S. T-Bills or other money market instruments. Kieran Osborne is Co-Portfolio Manager of the Merk Absolute Return Currency Fund, part of the Merk Mutual Funds that include the Merk Hard and Asian Currency Funds. The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes. The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand. The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability. The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com. Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest. The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses. This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Thank you for your interest in the Merk perspective. To serve our audience better and to continue offering our insights free of charge, please enter your information below to continue reading.

|

||||||||||||||||