Uncorrelated Returns

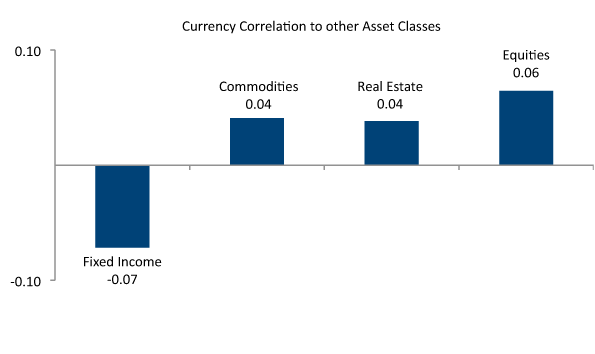

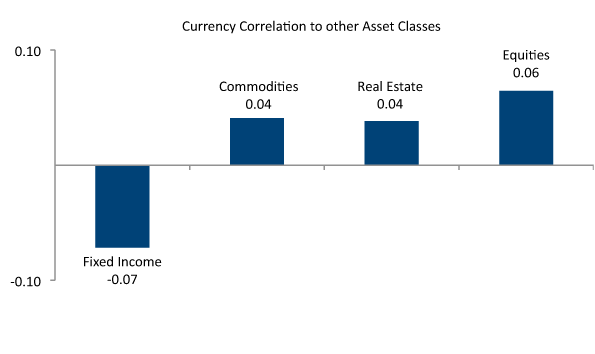

The currency asset class exhibits many unique attributes, and currency returns have traditionally exhibited low correlations to traditional asset classes. Investments in currencies, including gold (the only currency with intrinsic value) have shown strong returns over recent years. However, the most valuable contribution to a portfolio may stem from the fact that currencies are not correlated with most other assets. To a large extent, this is because currency valuations may be driven by factors different from those that drive the performance of traditional asset classes.

Source: Bloomberg, Merk Investments

The following indices are used as proxies for the respective asset classes:

All calculations based on daily data (12/31/2004 - 12/31/2009)

One cannot invest directly in an index, nor is an index representative of the Funds' portfolios.

Lower Risk

Currencies are the least volatile asset class when compared to equities and bonds. There is a popular misconception that the currency asset class is more “risky” than traditional asset classes. However, when no leverage is used, the currency asset class has historically demonstrated lower volatility compared to traditional asset classes, such as equities and fixed income. The Merk Funds typically do not use leverage.

Source: Bloomberg, Merk Investments, Deutsche Bank

The following indices are used as proxies for the respective asset classes:

- Equities - VIX Index: Chicago Board of Options Exchange Volatility Index.

- Fixed Income USSV055 Index: USD Swaption 5 Year Fixed/Floating Volatility Index.

- Commodities - CVIX Index: Deutsche Bank FX Volatility Index

All calculations based on daily data (12/31/1990 - 12/31/2009).

The y-axis represents annualized standard deviation of daily returns.

One cannot invest directly in an index, nor is an index representative of the Funds' portfolios.

Market Inefficiencies Possible profit opportunities may arise in the currency market due to its unique structure. As opposed to the stock market, where the vast majority of market participants invest for the specific motivation of making positive investment returns, there are many entities transacting within the currency space whose primary motivation is not to seek a profit.

For example, multi-national corporations may contract to buy or sell certain currencies for the primary reason of hedging against currency risk on future earnings or procurement expenses; governments are active in managing foreign currency reserves; tourists, too, are active currency market participants – even if they are unaware of it. These characteristics may lead to market inefficiencies and profit opportunities in the currency space, unobtainable in traditional markets.

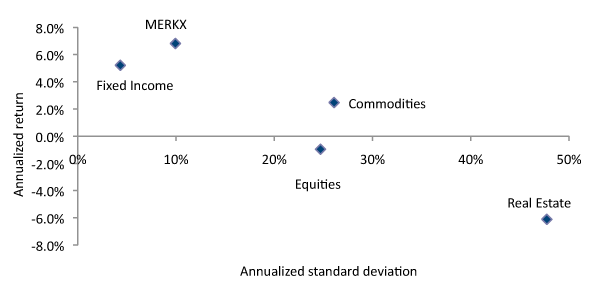

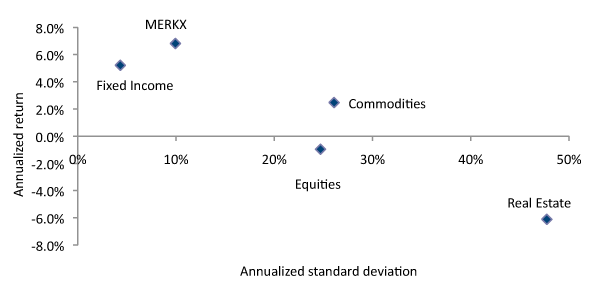

Favorable Risk/Return

Because of its unique attributes, investors may achieve more effective diversification by incorporating alternative investments such as currencies into their portfolios. As an example, the Merk Hard Currency Fund (MERKX), which has the longest track record of all the Merk Funds, compares favorably to other asset classes on a risk/return basis:

Source: Bloomberg, Merk Investments

Information contained herein may discuss Fund performance and holdings. Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. For performance current to the most recent month-end, please visit our website at www.merkfunds.com/fund. Through 3/31/22, the Merk Absolute Return Currency Fund Investor Shares (MABFX) had a 1-year return of , a 5-year return of , and a return of since inception on 09/09/2009; the Merk Hard Currency Fund Investor Shares (MERKX) had a 1-year return of -4.27%, a 5-year return of 0.07%, a 10-year-return of -2.1% and a return of 0.92% since inception on 5/10/2005. All performance figures greater than 1-year are annualized unless otherwise specified. The expense ratio for the Funds is 1.30%. In addition, these article excerpts and hyperlinks reference individual securities that may or may not currently be held by the Fund. Click here to view important information about the Funds, including their holdings. The views in these article excerpts and hyperlinks were those of the Fund's manager as of each article's publication date and may be subject to change.

The following indices are used as proxies for the respective asset classes:

Calculations for period 5/10/2005 (inception of MERKX) - 12/31/2009.

One cannot invest directly in an index, nor is an index representative of the Funds' portfolios.

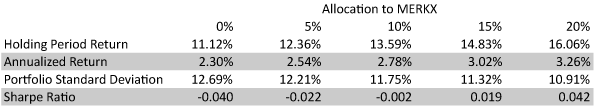

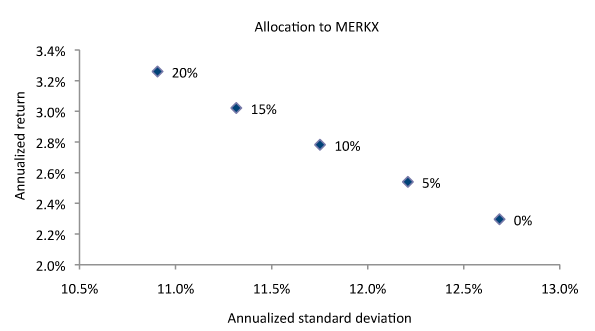

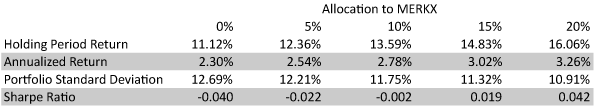

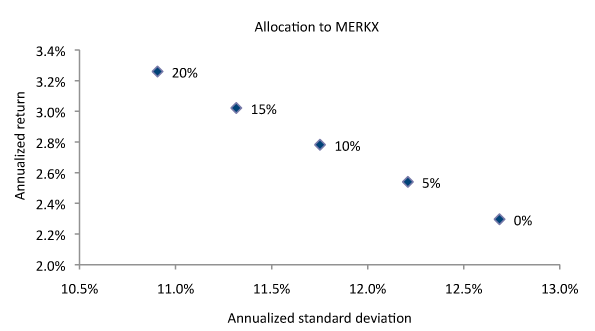

Portfolio Benefits

The table below illustrates the potential portfolio benefits an allocation to currencies may provide investors. This example uses differing allocations to the Merk Hard Currency Fund (MERKX):

Source: Bloomberg, Merk Investments

Remainder of the portfolio is equally weighted between stocks and bonds

Source: Bloomberg, Merk Investments

Calculations for period 5/10/2005 (inception of MERKX) - 12/31/2009.

Information contained herein may discuss Fund performance and holdings. Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. For performance current to the most recent month-end, please visit our website at www.merkfunds.com/fund. Through 3/31/22, the Merk Absolute Return Currency Fund Investor Shares (MABFX) had a 1-year return of , a 5-year return of , and a return of since inception on 09/09/2009; the Merk Hard Currency Fund Investor Shares (MERKX) had a 1-year return of -4.27%, a 5-year return of 0.07%, a 10-year-return of -2.1% and a return of 0.92% since inception on 5/10/2005. All performance figures greater than 1-year are annualized unless otherwise specified. The expense ratio for the Funds is 1.30%. In addition, these article excerpts and hyperlinks reference individual securities that may or may not currently be held by the Fund. Click here to view important information about the Funds, including their holdings. The views in these article excerpts and hyperlinks were those of the Fund's manager as of each article's publication date and may be subject to change.

The following indices are used as proxies for the respective asset classes

- Equities: S&P 500 Index.

- Bond Returns: FINRA - Bloomberg Active Investment Grade Corporate Bond Total Return Index.

One cannot invest directly in an index, nor is an index representative of the Funds' portfolios.

The Sharpe ratio is a measure of the excess return per unit of risk in an investment asset or a trading strategy.

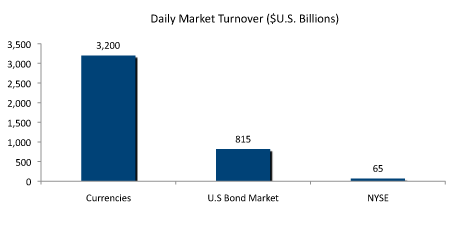

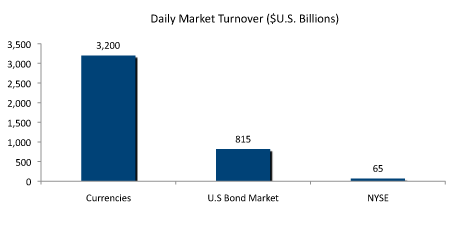

Liquidity

With $3.2 trillion traded daily, versus $815 billion in the US bond market, and $65 billion on the NYSE, the currency market is the largest and most liquid in the world.

Spreads and transaction costs in the currency market are typically lower than in traditional markets. Because of the high liquidity, the currency asset class may be less susceptible to liquidity runs, which have been an issue in other alternative asset classes (such as long-short equity funds).

Source: NYSE Euronext Statistics Archive 2008-2009, Securities Industry and Financial Markets Association (SIFMA) 2009, Bank of International Settlements (BIS)Triennial Central Bank Survey 2007

|